Save More Money Each Month With These Simple Changes

Does it feel like your monthly expenses are out of control? Are you looking for ways to add a little bit of cushion to your monthly budget? Luckily, hope is not lost. There are ways for us to save money without any drastic changes.

All it takes to save money is to make some simple changes in your everyday life.

Cancel Your Cable

Did you know that as recently as last year, the average cable bill was $99? Do you watch enough television to make spending $100 per month worth it? Couldn’t you be just as entertained watching movies or television shows streamed on Netflix for $10 per month?

Cut Your Phone Bill

Go over your phone bill with a fine tooth comb. I am willing to be that you are paying for stuff that you shouldn’t be. Whether it’s too much data, wasteful insurance or bonus extras that you didn’t even realize you were paying. This tip could save you a lot of money each month on your bill. Also, consider switching cell phone providers. Cell phone providers vary greatly in their costs, are you getting the best rates?

Lower Your Power Bill

Do you cringe every time your power bill shows up? There are a couple of things that you can do to keep that bill as low as possible each month.

Try these tips:

- Install a programmable thermostat. Do you find yourself heating or cooling the house all day, just so it is comfortable when you come home? The ability to program when your heating and air conditioning come on is a great way to save.

- Turn your water heater down to 120. You don’t need it any hotter and you will save on your power bill.

- Buy LED bulbs. If you haven’t made the switch already, buy LED bulbs for your lighting. These cost a fraction of what old incandescent bulbs cost in energy.

Use Coupons

Grocery bills are a huge expense for most families. Don’t be afraid to clip coupons and bring that expense down. The average family can save up to 40% on their monthly grocery bill just by shopping sales and using coupons.

Gaining More by Saving

A lot of New Year’s Eve resolutions start exactly like this: “starting with the 1st of January, things will change. I will start saving money and buy a new car or a new house.” But we seldom follow our resolutions because we get caught up in work, daily activities, responsibilities and whatnot.

You don’t need a specific date to start something important. You can start saving money on a Monday, on a Sunday, in the middle of the night or first thing in the morning. Just have a certain goal in mind and pursue it with all your physical and psychological effort. It’s a big step, but you’ll be getting what you want in the end and that is all that matters.

Use Your Skills

Do you have a sewing machine lying around the house? If so, use your skills and upcycle or redesign old clothes. Give them a modern vibe and wear something unique, made by you. If you are not certain of some sewing techniques, you can always watch some tutorials online, they’re free of charge. Kudos to saving money instead of going shopping!

Thinking about Your Kids

You love your kids and you want to pamper them, spoil them, buy them anything that they want. But kids are growing up so fast and their wishes change from one day to the next, it’s hard to keep up with them and it can also be so tricky, from a financial standpoint. You save money to buy them a certain toy but exactly when you have the amount of money you need to acquire something for them, they have already changed their mind and they want a totally different thing. There is a different approach when it comes to this situation. Get involved more in your children’s life. You are already giving your best, but try playing with them more often, because they’ll be so happy. You’ll be bursting with joy, too and you will forget about your worries when you see a smile on your kids’ face because you’ve played with them. You can take them hiking, too. Or for a picnic. Engage in fun activities. Pick easy DIY projects and create cool toys together. There are a lot of alternatives that will make your kids happy. And none of them involve expensive toys. Quality time, family time is one of the best feelings ever. You will gain more by saving money. You can save money for college tuition, thinking about their future in advance.

Leading a Healthy Life

Eating healthy and staying healthy does wonders for your health and for your wallet. Drinking water decreases your appetite (especially when you drink a full glass in the morning you won’t be tempted to eat too much) and eating healthy will give you the necessary strength to last through the day. You’ll also get used to the healthy diet in the end, being less and less tempted to give in to junk food or dine out at different fast food restaurants. You’ll feel good about yourself, too. And you won’t be spending tons of money on snacks.

Save money by being in shape!

You can save money by being in shape.

As someone who has struggled to stay fit, I realize that eating healthy and being in shape is easier said than done. But for those who are in good shape, you can save a lot of money on life insurance and individual health insurance plans. And as an added bonus, you’ll feel better and have more energy.

Being is shape can benefit your health in many ways—reduced risk of disease, more energy and a longer life, just to name a few. But enjoying a healthy lifestyle and keeping fit could also lead to a healthier bank account.

While you may think that the road to fitness is an expensive one—personal trainers and gym memberships don’t come cheap, after all—working out at home and incorporating more activity into your daily routine will get the job done for a fraction of the cost. And the long-term savings add up, too.

Here are five ways being in shape can help save you money.

You can save money on clothes

If you find yourself going up and down a clothing size every six months, you know that the cost of new clothing can really start to add up. Whether you’re a size 6 or a 16, keeping your weight—and clothing size—consistent means that you’ll be able to wear your favorite pieces longer, and can avoid the financial stress of repeatedly replacing your wardrobe.

Plus, bigger clothes cost more.

You’ll spend less money on transportation

Get your energy boost in for the day by walking or riding your bike to your destinations. You’ll save on fuel, vehicle wear & tear, parking, etc…

You’ll spend less money on unhealthy vices

Whether your vice is smoking, alcohol, or fast food, cutting those things out of your life can not only help you to be healthy, but it will save you money! If you smoke a pack of cigarettes per day, you’re throwing away approximately $3,600 a year.

Giving up unhealthy vices can cut your heart attack risk after one year. You’ll also have more cash in the bank—and who could argue with that?

You’ll spend less money on medication

The cost of medications for chronic health conditions, like heart disease, high blood pressure and type 2 diabetes can really add up. Adults who participate in regular physical activity will decrease their risk of more than 25 chronic health conditions. Keeping illnesses under control means less trips to the pharmacy and, less money being spent on medication for chronic health conditions each year.

Do you frequently find yourself buying sleep aids or headache medication? Being in shape is also linked to better sleep habits, which may save you money .

You’ll save money on your grocery bill

Over the past couple of years I have lost over 60 pounds with Weight Watchers. One thing I have learned is that being in shape isn’t just about how far you can run or how much weight you can lift. To enjoy a truly healthy lifestyle, you need to keep your diet in shape, too. When you are trying to be healthy you find that spending money on take-out and unhealthy restaurant grub seems like less of a good idea. The notion that fast food is less expensive than making a fresh meal is a common mistaken belief. With a little meal planning and smart shopping, you can eat healthy homemade meals all week for less than you would spend to take your family to the local fast food shop. If you do go out, just make wise choices on what you order, both in health and the cost.

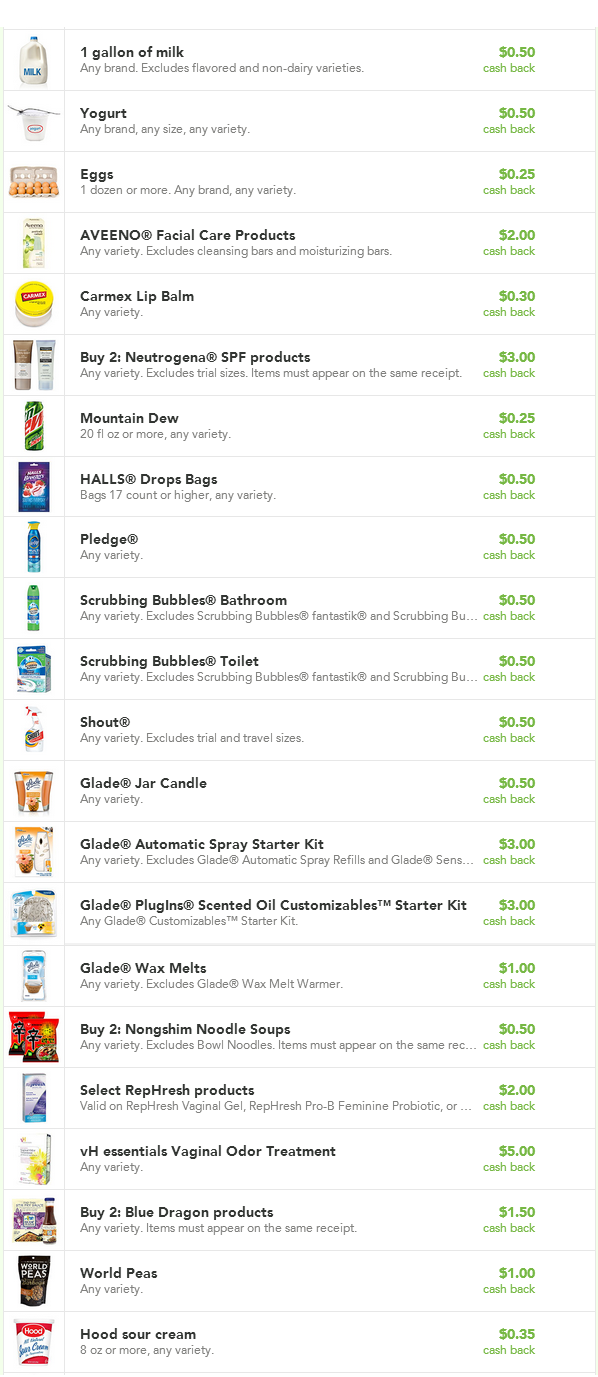

NEW Checkout 51 Offers Eggs, Yogurt, Milk, Carmex, Mountain Dew, and More!

Get cash back on your groceries! To save money with Checkout 51, all you have to do is…

- Browse the offers that are updated every Thursday

- Buy the products from any store

- Take a photo of your receipt to redeem your deal

- Get cash back!

Using Coupons Wisely – Let’s talk about using coupons and pinching your pennies!

Using Coupons Wisely

Using Coupons Wisely

Using coupons wisely is another key to successful coupon use. There are many ways to do this and maximize the savings. There are also many ways to use coupons and spend too much money. Far too many people jump into couponing and end up spending extra money and getting items they do not need.

The first way to be a wise coupon user is to avoid using a coupon just because you have it. If there is a coupon for an item that is not a great deal and you do not need it, do not buy it. You don’t have to use every coupon you have. Far too many people Unused coupons can be traded with other coupon users. Expired coupons can be sent to military bases overseas where they are valid six months past the expiration date.

Don’t buy more than you need. It may be tempting to buy as many of a good deal as you can. If toothpaste is almost free after a sale and coupon, you may be tempted to buy as much as you can. Some recent television shows have even encouraged this practice. In reality, wise coupon users only buy what they need and can use in a reasonable amount of time. Even spending a small amount on something turns into a waste if you won’t use it and end up throwing it away.

Watch the sales at different grocery stores. Pair the sales with your coupons to get great savings. Many times items are just a small fraction of their original price when you do this. This is how wise coupon users save the most money. Here at Pinching Your Pennies, we compare the ads and match the coupons for the grocery sales each week. This makes it so much easier for you. We also have a place in our forums for other coupon users to share deals they find each week.

Know the coupon policies at your local stores. Stop at the customer service desks and ask about their coupon policies. Some stores double and triple the value of coupons. Some stores will combine a manufacturer’s coupon with a store coupon. If a store has a coupon in their ad or in store and there is a manufacturer’s coupon for the same item, both can be used. Two manufacturer’s coupons can not be combined. There are some stores that accept competitor’s store coupons.

Read each coupon carefully. Most state “one coupon per purchase”. Each item bought is a purchase. If you purchase 10 toothbrushes you can use 10 coupons for them. This is another way wise coupon users maximize their savings. Buy multiple of whatever you will use when it is a great price. It is quite rare for a coupon to state “one coupon per customer”.

When coupons are collected, organized and used in these ways it is easy to slice your monthly grocery budget in at least half. We have lots of other great ideas to help you do this. Watch tomorrow night for another blog in this series.

Coupons 101 – Let’s talk about using coupons and pinching your pennies!

At Pinching Your Pennies we have decided to bring you a multi-part blog series about using coupons. There has been a lot of talk about coupon use, both good and bad lately. Recent popular shows have made coupon use look like crazy behavior and scared many away from using coupons. People on these shows buy 52 bottles of mustard or 79 toothbrushes and try to call it normal coupon use. No way! In reality, most coupon users are normal shoppers who shop very unnoticed through the store. Let’s get down to the basics!

At Pinching Your Pennies we have decided to bring you a multi-part blog series about using coupons. There has been a lot of talk about coupon use, both good and bad lately. Recent popular shows have made coupon use look like crazy behavior and scared many away from using coupons. People on these shows buy 52 bottles of mustard or 79 toothbrushes and try to call it normal coupon use. No way! In reality, most coupon users are normal shoppers who shop very unnoticed through the store. Let’s get down to the basics!

Coupons 101

Is clipping and using the grocery coupons in the Sunday newspaper a waste of time? No! Using coupons, smart shoppers have learned how to live on a grocery budget of less than they ever imagined! Savings may be small in the beginning but with knowledge, time and practice coupon shoppers are saving more than ever imagined. Even if you don’t NEED to pinch your pennies, you can still have more than you ever thought you could! Who couldn’t use a little extra money? Extra savings in the bank, extra vacations, a new car, there are lots of things all of us could do with a little extra money. It is so much easier to save money versus earning more money. Using coupons and saving at the grocery store is so easy to do and the savings can really add up!

Accumulate Coupons

The first step to achieving these terrific savings and successful coupon use is accumulating coupons. Each week there are usually two different coupon inserts in metropolitan newspapers with a third insert available once a month. Having multiples of each coupon enables a shopper to take advantage of the great deals in bulk. This will help you build a useable food storage. Obtaining multiples of coupons is not difficult. Family, friends, neighbors and co-workers are great sources for obtaining multiple coupon inserts. Find friends who are coupon users and trade the coupons from Sunday paper that you can’t use, for coupons that you can.

Another source of coupons is the internet. Printable coupons and coupon offers can be found at many manufacturer and coupon related websites. Many manufacturers also offer coupons which are sent post mail. If you watch our blog, forums and emails you’ll see that we bring you links every day to many of the great printable coupons around the internet.

Additional coupons and in-store savings can be found at most grocery stores. Coupons commonly called blinkies are available in red machines set up in aisles in the stores. There are also lots of other displays and coupon holders out in the stores. Pay attention as you go down the aisles and you’ll learn to spot these easily. Also, apply for grocery store courtesy cards. Most grocery chains have these complimentary cards which provide extra discounts and savings at their stores. These discounts can be combined with coupons for maximum savings.

It sounds crazy but this is actually the hardest step. Deciding to start using coupons and making a plan to gather them really is the hardest part! Stay tuned… tomorrow we will talk about getting organized!

Easy Ways To Double Your Money

If you’re looking for some easy ways to double your money, you’re in the right place as we have a few for you. Not only are these some very effective ways to double your money, we actually have some experience with all of these methods. Whether or not they are right for you is up to you to decide but one thing is for certain. If you play your cards right (literally) then you can most definitely turn a dollar into two dollars or maybe even more.

Make A Bet

The first option that we have for you is to make a bet. Betting is a very old and effective method of making money but we want you to be careful. Never bet more than you can afford to lose. We know that you don’t want to lose any money and that’s never your intention but just remember what we said. Don’t bet $20 if you can’t afford to lose it. Bet only on what you’re knowledgeable about and start out small. If you do this, betting could become a very comfortable way for you to make some extra money and have some fun!

Flip An Item

The next option that we have for you on this list is to flip something. What do we mean by flip? Well, it’s when you buy something and sell it for more. Wait, people do that? Yep! Try buying a domain, a figurine, or even a coin to get started. See if you can land a good deal on something and then turn around and sell it for more. This is the art of flipping and if you know what you’re doing, you can definitely always double your money. Give it a shot!

Sell Your Junk

Do you have some old stuff laying around that you don’t have any money in at all? Maybe it’s something that someone gave you and you don’t even use it. There’s no point in letting it pile up. Sell it for a profit and if you don’t have any money in it, you’ll more than double your money. In fact, you may make your money back (which was nothing) by 1,000%. So, with that being said, see if you have anything laying around that you don’t want and sell it.

Invest

Finally, the last option that we have for you to double your money is this. Invest! Yes, it’s not a fail proof method of doubling your money but it does happen. This will require a lot of research and a little bit of luck but you can definitely do it. A good rule of thumb is to invest in a product that you would use. It’s much easier that way and it will be a lot of fun!

So, there you have it! Those are some of the best ways of doubling your money that we’ve came up with. Are you looking forward to trying them? If so, let us know and then come back and let us know how you did. We’d absolutely love to hear how they worked for you!

Saving Money With Leftovers

Walk into any house that has a husband, wife, and kids. Once you’re in there, we’re willing to bet that you’ll find at least one thing in the fridge. Leftovers! Yes, that’s right! Almost all of us are familiar with leftover food and quite frankly, we like leftovers better sometimes. An example of that would be leftover chili but that’s besides the point. The point here is how you can save money with your leftovers instead of just nibbling on them during the night and then throwing it all out the next day. If you want to learn how to do this, go ahead and scroll down now. We promise it’ll be well worth your valuable time!

Make Something Else

The first tip that we have for you is to simply make something else out of your leftovers. For example, if you have rice as a side dish one night, turn the leftovers into rice pudding. You may even be able to make rice cakes depending on how well you can cook. What if you have some leftover fried potatoes? Mash them up and make some spicy mashed potatoes. Regardless of what you do, try to be fun and creative with your leftovers.

Freeze Them

If you make any type of soup for dinner and you have the bulk of it left over, try freezing it. Generally speaking, you can freeze stuff like this for quite a few months before you ever have to worry about it going bad. We know a lot of people who freeze vegetable soup as well as chili and deer gravy. Just make sure that when you do thaw it out, you thaw it out over night in the fridge and consume it the next day. If you can’t, don’t eat it.

Eat It Again

The next tip that we have for you is probably the most obvious one. Sure, you probably never thought to make a completely different meal out of your leftovers nor did you think about freezing them. You probably did think about this one though. Yes, our third tip is to eat the leftovers again the very next day. Heck, you could even eat that same meal a few times a day if you’d like. As mentioned above, we think chili is better the next day so try fixing a bowl for lunch AND dinner. You’ll save a ton of money and it’s equally as good.

So, that wraps up our quick list on how you can save money with your leftovers. To recap, we recommend eating them again, freezing them, or making a completely different meal out of what you have left. Do you have any tips on ways to save money with leftovers? If so, don’t be afraid to drop us a line and let us know. We absolutely love to hear from our readers and read everything that is sent to us (whether we take the advice or not). So, what are you waiting for? It’s time to have fun, eat good, and save a little bit of money!

Saving Money With Rising Gas Costs

With gas costs beginning to flip flop around, we thought that’d put something together for you that will help you save money on gas. It could be for a big summer trip, it could be for the commute to work, or it could even be for those random trips to town that you hardly ever take. Regardless of what you need to cut gas costs for, we’re here to help. So, with that being said, scroll down now to find out how you can cut costs on gas costs right now.

Car Pool

The first thing that you can do to save money on gas is to car pool. No, we’re not asking you to pile in your car with 8 other people and make the journey to work together. But, if you have a neighbor close by that works with you or your significant other works close by, ask them to ride with you during the week. You can split the gas costs and alternate weeks. That way, there’s not too much wear and tear on anyone’s car and you save 50% of your money. This works really well but just make sure that you have someone to ride with you.

Pay With Credit

The second thing that we recommend doing to cut down on gas costs is to pay with credit. The only reason that we recommend doing this is because it may be easier to have one solid bill every month for the gasoline bought versus forking out $10 a day in cash for gas. Just make sure that you can pay it off every single month and the interest rate isn’t high.

Trade In Your Old Car

If you’re driving an older car that you’ve made major repairs to and are struggling with the cost of gas, you may be better off trading in your old car for a new, fuel efficient car. The average American can afford a $15,000-$20,000 car if they make the average income. Even if you can’t buy a newer car than yours but get it used. You’ll save a ton of your money!

Get Rewards

Finally, the last tip that we have for you to save money on gas is to sign up for rewards cards. Most gas station chains, like Shell, have rewards cards that will save you money on gas. Some grocery stores even offer this now so definitely take advantage of that. We know that you can save as much as 20 or 25 cents off a gallon with these rewards cards.

And that’s all that you have to do to save money on gas. We know that gas costs have been going up lately and it’s likely that we’ll one day see gas that costs as much as $5 a gallon one day. Be prepared for when that happens and save up a little extra money in the meantime. Then, if it ever gets that high again, you can apply these tips and save money!

Easy Ways To Save Money On Taxes

If you work then you probably pay taxes. Do you remember the old saying that goes a little something like, only too things are guaranteed, death and taxes. That’s pretty much a very true statement. However, you can always save a little money on your taxes if you know what approach to take and a few loop holes in the system. Okay, so they aren’t exactly loop holes but there are a few ways that you can save money on your taxes and get the best tax return possible. If you’d like to find out how to do this, scroll down and enjoy!

Write Offs

If you work from home or operate your own business, almost everything could potentially be a tax write off. If you buy a new computer this year, you can write it off on your taxes. If you get a new computer chair, you can write it off on your taxes. Talk to a qualified tax agent and find out what all you can potentially write off of your taxes this year and do it.

Filing Status

Typically, if you file with yourself as a dependent, less money is taken out for taxes and if you file with 0 dependents, more money is taken out. It’s up to you to decide how you want to file though as filing with 1 dependent will mean less taxes out of your check but a smaller tax return. Filing with 0 dependents means more out of your check and a big return.

Learn The Laws

Do a little bit of research and find out how your state taxes work. Some states don’t even have a state tax. An example of that would be Tennessee. Do your research and find out if there are any areas that you can save money. Doing this will ensure that you understand how taxes work for you personally and you’ll discover ways to save money on taxes.

Go The Extra Mile

No, we aren’t asking you to start jogging. When you fill out your tax forms for your employer, take out a little extra. A lot of people take an extra $50 out of their in order to make sure that they pay in enough and get the best possible tax return. You don’t have to do this but we just pointed out that this is technically a good way to save/get money.

So, there you have it. If you apply these tips and use them when you start planning for tax season, you very well may end up saving a big chunk of change. Reducing how much you pay in via taxes or increasing how much you get back will almost definitely make your year a lot better. Now, what are you waiting for? Let’s start saving a little money on taxes! It will probably be one of the most beneficial things you can do for your home based business or just for your finances in general. In other words, it can be a big time life changer!